irs tax levy program

The IRS can issue a levy to seize take your income and assets. Under this program the IRS can generally take up to 15 percent of your federal payments including Social Security or up to 100 percent of payments due to a vendor for.

The Federal Payment Levy Program

It is the process to solve back taxes issues with the IRS.

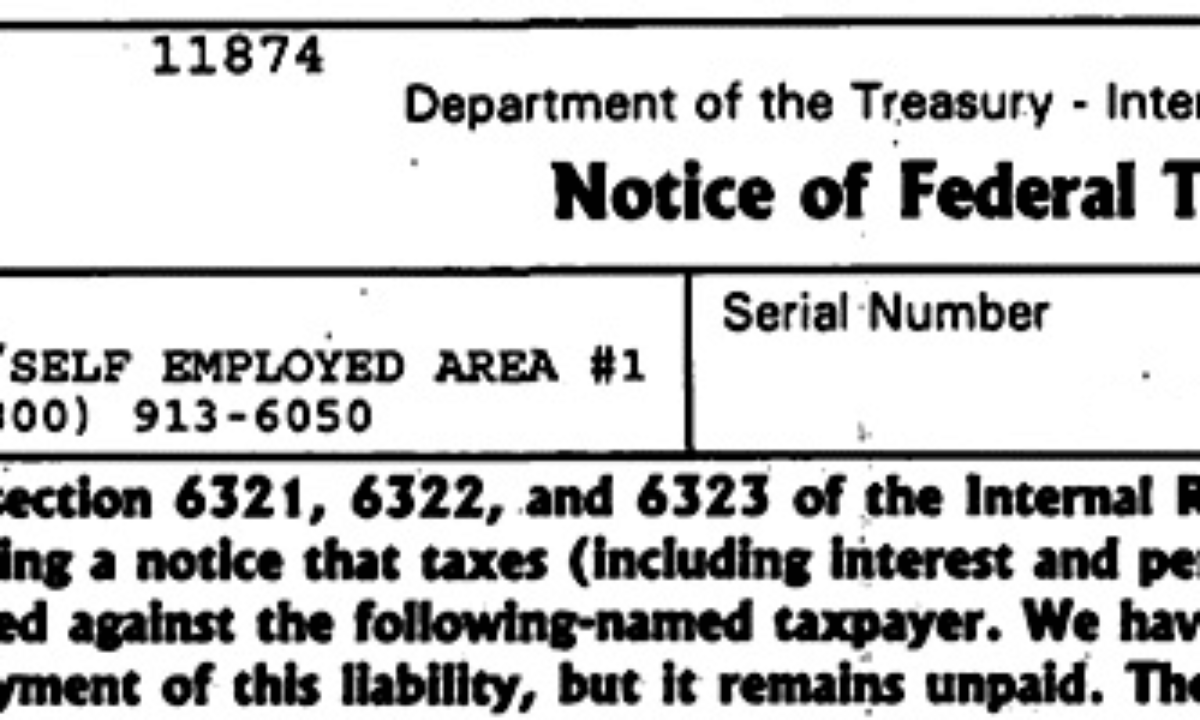

. The umbrella term tax resolution refers to the dispute resolution and prevention Program offered by the IRS. Notice of intent to. The Federal Payment Levy Program FPLP allows the Internal Revenue Service IRS to apply a continuous tax levy on specific payments that are issued through the FMS.

First the IRS must provide you with. The Federal Payment Levy Program is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service since 2000. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

In last weeks blog I described the Federal Payment Levy Program FPLP and outlined my general concerns about the IRSs implementation of the Low Income Filter LIF. The internal operating procedures of the IRS known as the Internal Revenue Manual specifically instruct its employees to delay sending a copy of the tax levy to the taxpayer. What is an IRS Levy.

It can garnish wages take money in your bank or other financial account seize and sell your vehicle. When taxpayers do not pay delinquent taxes the Internal Revenue Service IRS can work directly with financial institutions and other third parties to seize the taxpayers. The process follows several steps.

Notice and demand for payment.

Everything You Need To Know About The Irs Fresh Start Program Fidelity Tax

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Example Of Loading Federal Tax Levy Involuntary Deductions For Us Employees

Contesting An Irs Levy Insight From The Tax Lawyer

Irs Tax Debt Relief Forgiveness On Taxes

Irs Offset Intent To Offset Tax Refunds Help Community Tax

Irs Tax Levy Tax Law Offices Of David W Klasing

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Tax Administration Irs Levy Of Federal Payments Could Generate Millions Of Dollars Unt Digital Library

Tax Debt Relief 20 20 Tax Resolution The Tax Experts

What Is The Difference Between A Lien And A Levy Pittsburgh Irs Tax Relief Attorney

Tax Levy What It Is And How To Stop One Nerdwallet

Irs Tax Relief Back Taxes Tax Relief Programs

How To Stop A Wage Garnishment Advance Tax Relief

Can The Irs Take Your 401 K For Back Taxes Community Tax

Irs State Tax Levy Guide How They Work How To Stop Help